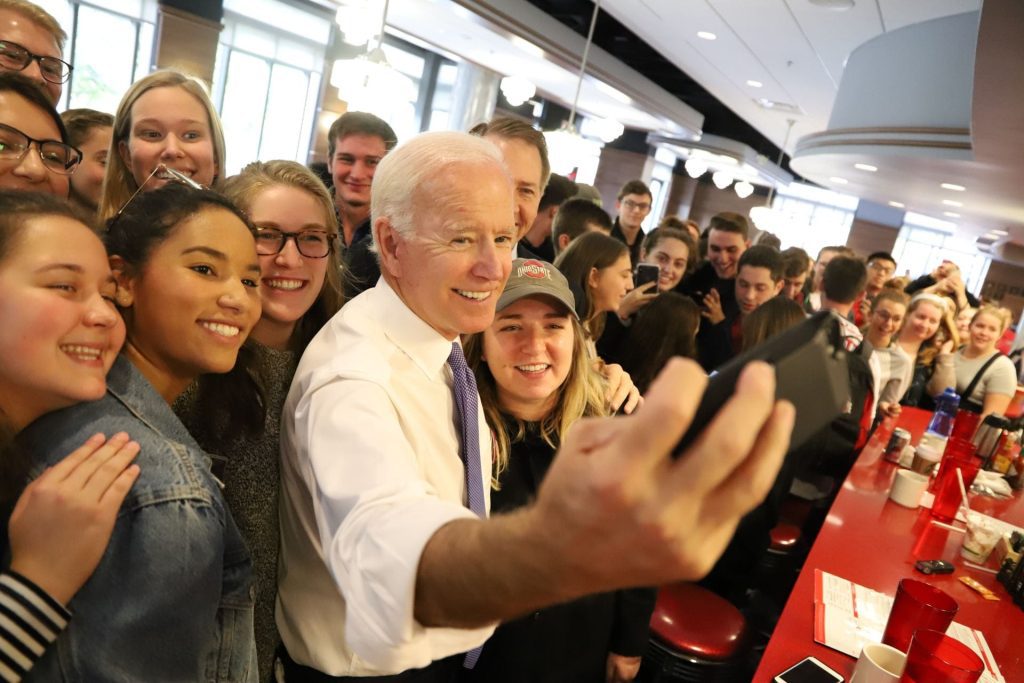

President Joe Biden announced student loan relief measures on a large scale. In the U.S., the level of student loan debt has become a crisis, affecting not only its main victims (borrowers), but damaging the broader economy. The plan goes beyond the immediate future, seeking to reform student loan system and ensure long-term financial health for the coming generation’s. Among other measures, it provides protection for lenders and prevents them paying up front fees.

The crisis of student debt. Just how bad is it?

The issue of student debt in the United States has been growing more and more inflammatory over time. By 2024, the nation’s student debts were as high as they had ever been: some 45 million Americans owed a combined $1.7 trillion worth of money, second only after mortgages. Young people in particular are disproportionately burdened with this kind debt, However, as it holds off the ability to buy homes, it delays family formation altogether and impacts their ability to generate income in future years. With college costs spiralling upwards while salaries have remained stagnant for a generation or more now students are finding it increasingly hard after they graduate from school to pay back their college loans. The pupils of today are struggling against severe indebtedness which their predecessors did not see to anything like the same degree.

The impact of this debt goes beyond the borrowers themselves. It has repercussions for the US economy as a whole too, with temporary lulls in consumer spending and long-term consequences on rates of homeownership and, thus, economic growth Recognizing these problems, the Biden administration has made student loan relief an important part of its economic policies.

Key Components of Biden’s Student Loan Plan

President Biden’s plan to ease student loan debt is multi-faceted, not only providing immediate relief for today’s borrowers but also making systemic changes in order to prevent future crises. This includes:

Immediate Debt Cancellation: The most straightforward part of the package calls for doing away with up to $20,000 in federal student loans for eligible borrowers. Millions of Americans are expected to benefit by this, particularly those from low- and middle-income families. To qualify, borrowers must have incomes below a certain threshold to make sure that relief goes where it is needed most.

Interest Rate Reduction: The plan also includes cutting interest rates on federal student loans. This is aimed at making repayments less burdensome by lowering the overall cost of borrowing. As it stands now, interest rates can be as high as 7% on federal loans which significantly inflates the total repaid over the life of the debt.

Expansion of Income-Driven Repayment Plans: The Biden administration has proposed expanding and simplifying income-driven repayment (IDP) plans that cap monthly payments at a portion of a borrower’s discretionary income and write off any remaining balance after a set number of years. Under the new plan: the payment will be capped at 5% of discretionary income forgiveness period would be just 10 years for those with lower-balance loans, Twenty for borrowers who have larger ones.

Public Service Loan Forgiveness (PSLF) Improvements: The PSLF program, which forgives the remaining balance after 10 years of service work on federal student loans for borrowers in public service jobs, has had administrative challenges and low approval rates. Biden’s plan includes reforms to streamline applications and increase eligibility rolls, making it easier for those working in public service to access this relief program.

Tuition-Free Community College: As part of a longer-term strategy to ease the student debt burden of future generations, the plan proposes free tuition for all students in community colleges. In this way it aims to offer students seeking higher education more pocket-friendly choices and to lessen those loans they are forced to take out.

The program’s function is to give immediate assistance to borrowers

The government’s announcement of Biden’s student loan relief plan has won wide praise from debtors and support groups. For tens of millions of Americans who are still carrying student loans, the immediate cancellation of up to 20 000 dollars is a big relief.

With this reduction, debt-holders’ income is freed up to pay for other things which are just as essential: a home, health care and the setting aside of funds for future use.

For people with more debt, the lower interest rates and wider choice of income-driven repayment plans makes it possible for them to handle their installment payments better than they have in years past. With sums limited to 5% of what borrowers make on their own, gifts of loans to get out from under a backlog are much less burdensome opportunity costs and how much effort they can accept. Along with a shorter payback period for lower balances also comes reduced hopelessness; many beneficiaries soon find that their debt has disappeared altogether.

Wider Economic Implications

In addition to benefiting individual borrowers in the short term, President Biden’s student loan forbearance initiative is expected to produce good medium- to long-term effects. While manipulating away debt, it aims to expand consumer spending and revitalise the American Economy. By putting graduate loans behind, consumers who used to devote a large proportion of their monthly pay to the banks will have more disposable income– creating additional demand in our economy.

The plan is also likely to have positive effects on the housing market. High levels of student loan debt have been cited as a significant obstacle to home ownership for young people. With debt burdens lightened, more graduates may be in a position to save money for a deposit and qualify for mortgage financing; and this encourages home buying or rekindles a strong residential real estate market.

And finally, the move to make tuition-free at community colleges goes to the root flood of the student loan crisis: the high cost of education. By providing students with more economical educational choices, this plan aims to obviate the need for future students to assume such large amounts of debt. It ensures a stronger financial underpinning for institutions of higher learning at large.

Criticism

But like every government scheme, the student loan relief plan introduced by President Biden is accompanied by arguments over its drawbacks. From among colleges and universities in particular, both officials and economists find fault that the policy has not gone far enough in dealing with a student debt catastrophe. They argue that with a limit of $20,000 of forgiveness for all debts owed – including considerably higher sums, refunds apply only to this extent C and none of them are relevant.

Another concern is the long-term fiscal impact. The measure of cancelling student debts and lowering interest rates will not be cheap, some questioning what it will do to federal budget and its burden on taxpayers. There is also disagreement about the justice of debt forgiveness, some argue that it primarily benefits college graduates to the detriment of non-college people or individuals who have already paid off their loans.

The Road Ahead

Students’ debt is a program resembling Joe Biden’s name and conveys distress. Whether it has made a difference in student loan reform remains to be seen. But the administration has stressed repeatedly that this plan is just the beginning point for efforts to change our higher education system and make sure future generations are not saddled with unliveable amounts of coffers.

The plan now depends on how well it is implemented and whether political or economic challenges can trip it up. It depends as well upon seeing that when it benefits the needy masses. Meanwhile, in order to ensure future debts do not land us in this same place once again, our educational institutions must be reformed.

Conclusion

In the fight against student debt in America, President Biden’s program to relieve the student loans is a watershed. The plan reduces interest rates and provides immediate relief to borrowers who face severe financial difficulties. It offers two major remedies–one for conditions caused by long-term joblessness, another that can help young people get out of school and into work. This blueprint has something of both a short-term measure: combined with an area of attention over the medium-to long-term (free community college tuition). The aim is to cure disease and its root causes with particular care for those who suffer most from chronic poverty.

Yet now comes the pay-off for the plan. The interest rate cuts are meant to ease financial burdens on millions of Americans, while a doubling of Pell Grant funding will help stimulate economic growth. As this plan goes into effect, people will watch it like a hawk: for what effect it has on those who borrows.